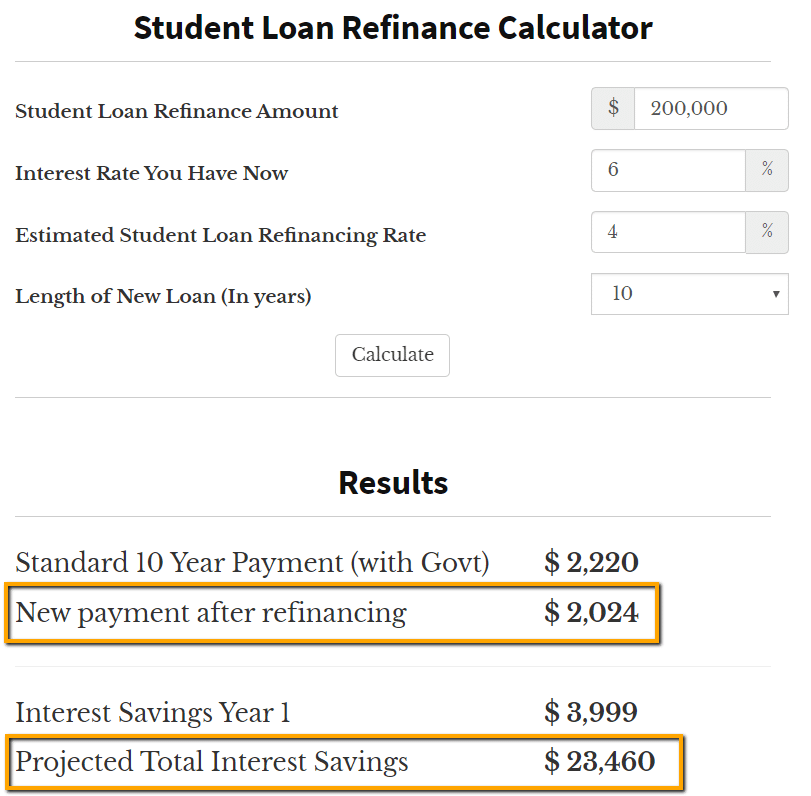

Antwort How much is a 200 000 student loan monthly? Weitere Antworten – How much is $200 000 in student loans monthly payment

Let's say you have $200,000 in student loans at 6% interest on a 10-year repayment term. Your monthly payments would be $2,220. If you can manage an additional $200 a month, you could save a total of $7,796 while trimming a year off your repayment plan.Example Monthly Payments on a $100,000 Student Loan

| Payoff period | APR | Monthly payment |

|---|---|---|

| 3 years | 6% | $3,042 |

| 5 years | 6% | $1,933 |

| 7 years | 6% | $1,461 |

| 9 years | 6% | $1,201 |

$20,000 loan over 20 years at 6.0%

For that amount, the payment on a 20-year loan at 6% interest would be $270 a month. For a 10-year loan, the monthly payment would be $419.

How much loan can I get in Germany : How much loan / mortgage can I afford As a rule of thumb, you just need to multiply your monthly net income by 100 to get the maximum loan amount most banks will provide to you. This amount can be 100% of the purchase price.

How much is the monthly payment for $300000 student loans

For example, if you had $300,000 in federal student loans and paid them off on the standard 10-year repayment plan with a 6.22% interest rate, you'd end up with a monthly payment of $3,364 and a total repayment cost of $403,663.

Is all debt bad debt : Debt can be good or bad—and part of that depends on how it's used. Generally, debt used to help build wealth or improve a person's financial situation is considered good debt. Generally, financial obligations that are unaffordable or don't offer long-term benefits might be considered bad debt.

Several options could help you pay off $100,000 or more in student loan debt, such as refinancing or federal student loan forgiveness. Eric Rosenberg is an expert on personal finance.

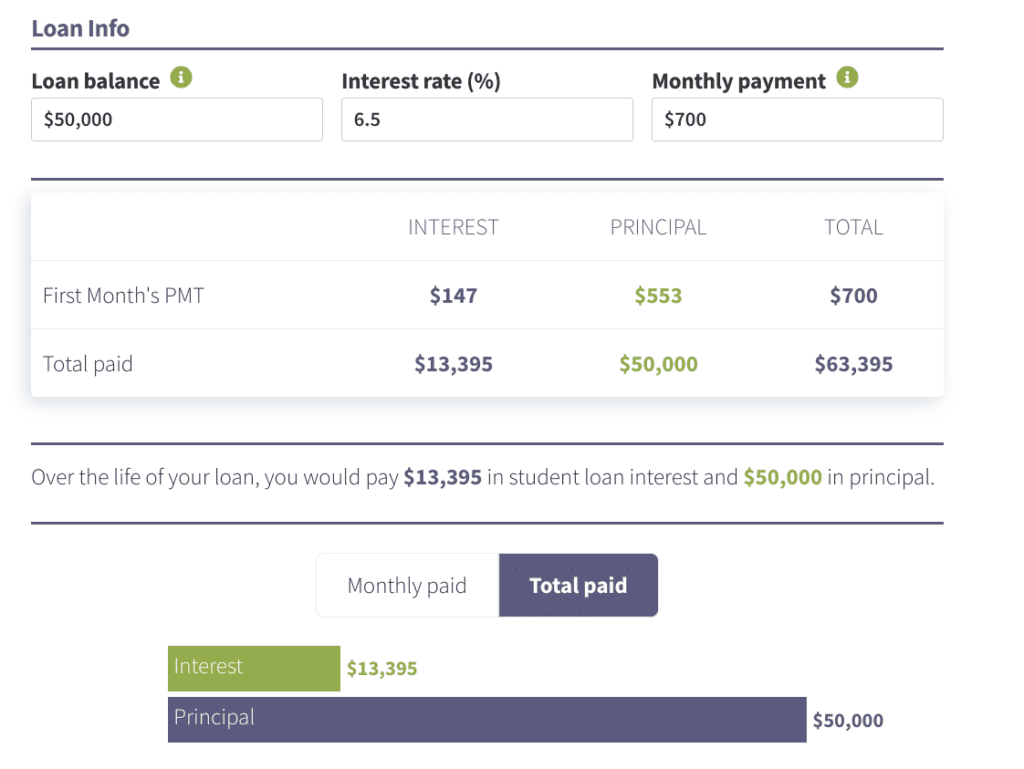

What is the monthly payment on a $70,000 student loan The monthly payment on a $70,000 student loan ranges from $742 to $6,285, depending on the APR and how long the loan lasts. For example, if you take out a $70,000 student loan and pay it back in 10 years at an APR of 5%, your monthly payment will be $742.

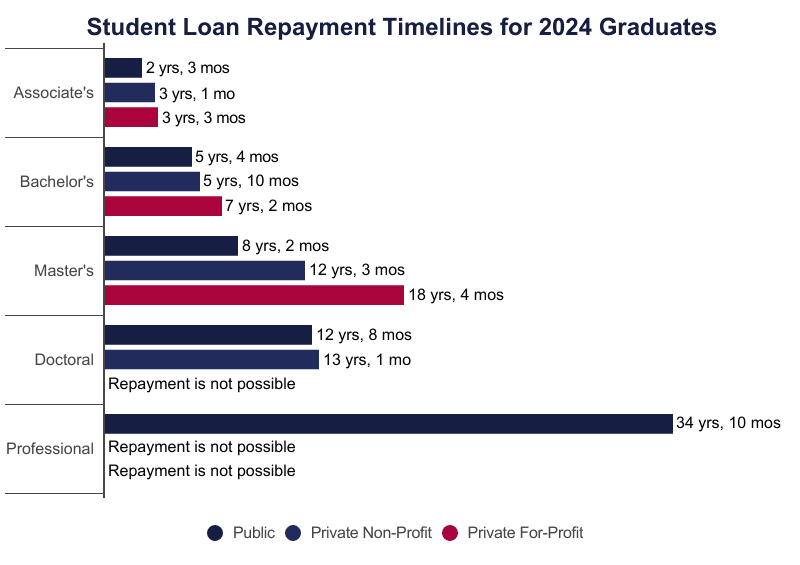

How long do you have to pay off student loans

Payments are fixed and made for up to 10 years (between 10 and 30 years for consolidation loans). Monthly payments can be higher than other plans, but total interest paid is usually lower and length of repayment is usually shorter.You must be 18 years of age or older. You must have a regular income or should be able to prove a steady and sufficient proof of income( 3 – 6 months of pay slips for employees, up to two years of balance sheets for freelancers) be presenting a decent SCHUFA score. You must have a bank account in Germany.How Good Is A Salary Of 60.000 Euros In Germany As you do your research, you may see in different forums that 60.000 euros gross a year in Germany is considered to be a good gross salary. It is well above the average salary of 47.700 euros per year and slightly above the national average.

What is the monthly payment on a $60,000 student loan The monthly payment on a $60,000 student loan ranges from $636 to $5,387, depending on the APR and how long the loan lasts. For example, if you take out a $60,000 student loan and pay it back in 10 years at an APR of 5%, your monthly payment will be $636.

How long will it take to pay off student debt : Data Summary. Student loans can take 5-20 years or longer to repay. It would take the average bachelor's degree graduate about 10 years to pay off their student loan debt if they made debt payments of $300 a month. 18 million federal student loan borrowers are on a 10-year repayment plan.

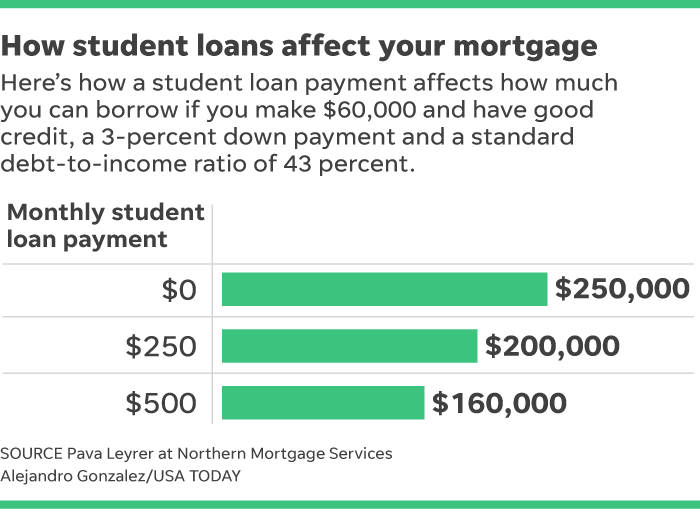

How much debt is ok : Debt-to-income ratio is your monthly debt obligations compared to your gross monthly income (before taxes), expressed as a percentage. A good debt-to-income ratio is less than or equal to 36%.

How much debt is too high

Key Takeaways

If you cannot afford to pay your minimum debt payments, your debt amount is unreasonable. The 28/36 rule states that no more than 28% of a household's gross income should be spent on housing and no more than 36% on housing plus other debt.

If you find yourself unable to pay your student loans because times are tough, here are some student loan repayment options to consider.

- Contact your loan servicer to discuss your options.

- Change your repayment plan.

- Look into consolidation.

- Consider deferment or forbearance.

- Look into loan forgiveness.

- Hear from an expert.

Average Student Loan Payoff Time After Consolidation

| Total Student Loan Debt | Repayment Period |

|---|---|

| $10,000-$20,000 | 15 years |

| $20,000-$40,000 | 20 years |

| $40,000-$60,000 | 25 years |

| Greater than $60,000 | 30 years |

Do you have to pay off student loans in 10 years : The repayment term is 10 years if you borrowed $12,000 or less. The repayment term increases for every $1,000 you borrowed above this amount until you reach the cap of 20 or 25 years. 20 year repayment term cap if all loans you're repaying under the plan were received for undergraduate study.

![csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c1-1024x521-65x65.jpg)

![Ischiasschmerzen[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/Ischiasschmerzen1-1024x640-65x65.jpg)

![csm_blogbeitrag_autoimmunerkrankung_d307ac8b72[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_blogbeitrag_autoimmunerkrankung_d307ac8b721-1024x576-65x65.jpeg)