Antwort Is PayPal useful in Germany? Weitere Antworten – Is PayPal widely used in Germany

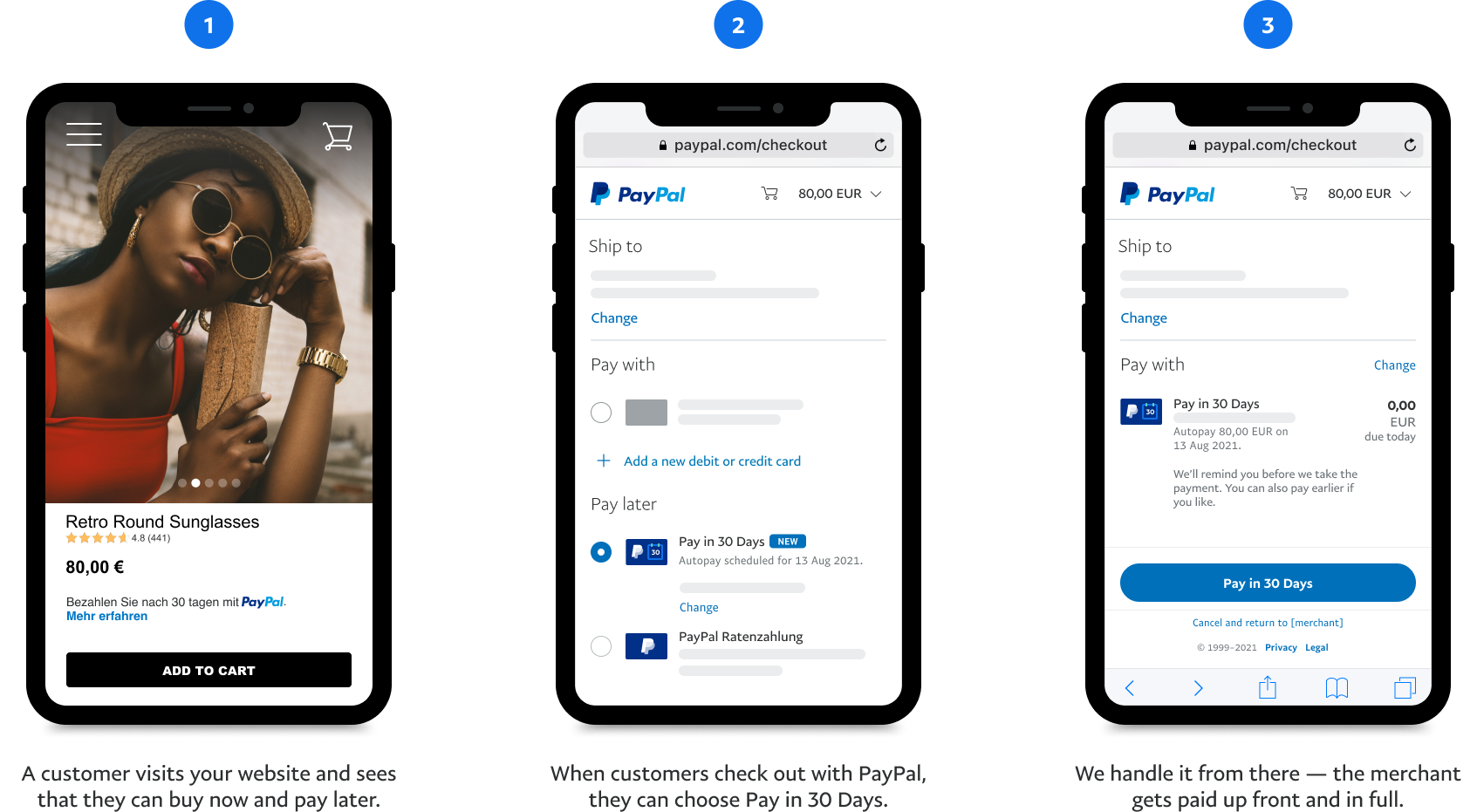

PayPal's Global Adoption: In Europe, PayPal is highly prevalent, with Germany leading at a 93% adoption rate among online stores.A German PayPal account is a very easy and safe way to pay for online purchases and send money to loved ones. Simply link your bank account or credit card to begin paying in a very private manner (the recipient can only see your email address).PayPal

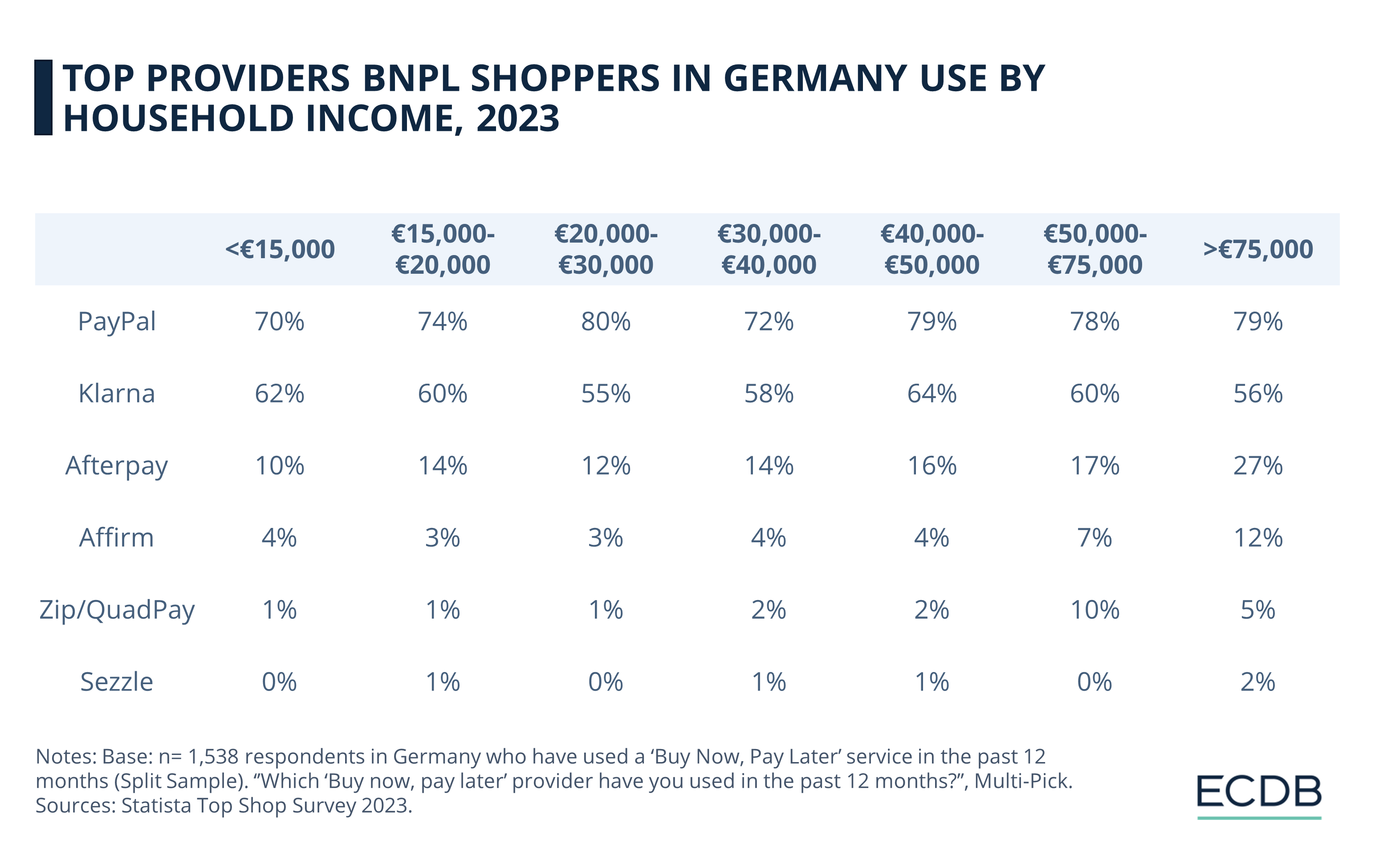

1. PayPal. PayPal dominates the online shopping rankings in Germany. According to a recent report, 57% of German consumers chose PayPal instead of one of the other competing mobile payment options.

Where can I pay with PayPal in Germany : Download a list of all 257,692 PayPal Customers Germany

| Website | Location | Employees |

|---|---|---|

| ebay.de | Germany | 10,000+ |

| mailchi.mp | Germany | 1,000+ |

| kleinanzeigen.de | Germany | |

| xing.com | Germany | 1,000+ |

Does PayPal charge fees in Germany

It's free to use PayPal to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.

Why is PayPal so popular in Germany : Germans have much favoured payment on account (essentially bank transfer but traditionally once the goods are delivered) and so this is a massive change in consumer behaviour. Paying with PayPal is quick and convenient for customers, but not exactly cheap for retailers.

Watch out for these common scams:

- Phishing email/message.

- Invoice and Money Request scams.

- Advance fee fraud.

- Overpayment scam.

- Prize winnings.

- High profit – no-risk investments.

- Fake charities.

- Shipping scams.

It's free to use PayPal to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.

How do I withdraw money from PayPal in Germany

Go to Wallet. Click Transfer Money. Click Withdraw from PayPal to your bank account. Select Instant (Free) or Standard (Free).How much is the PayPal fee for $100 For the most common PayPal fee of 3.49% + $0.49, the fee for a $100 transaction will be $3.98, making the total money received after fees $96.02. Example 1: You send an invoice to a client for $500 to be paid via PayPal Checkout or Guest Checkout.With PayPal there are no monthly fees or set-up costs. You pay only when you complete a sale and can apply for discounted rates based on your sales volume.

Also, concerns about data privacy and fraud have led to a preference for secure digital payment methods. Thus, services like PayPal, Amazon Pay, and mobile payment apps have become integral to everyday life. Moreover, 57% of German consumers chose PayPal over competing mobile payment services.

Is it risky to use PayPal : PayPal secures and encrypts transactions on both ends to ensure that the platform is safe to use for both buyers and sellers. As long as you have a secure connection to the legitimate PayPal website, your personal information and data should be safe when paying with PayPal.

What are two disadvantages of PayPal : Now, let's dive into the disadvantages of PayPal that business owners might face.

- Transaction fees. One of the most significant drawbacks of using PayPal for small businesses is its transaction fees.

- Account holds and limitations.

- Lack of customization.

- High currency conversion fees.

- Potential for chargebacks.

What is the 4.99 fee on PayPal

When sending money directly to another PayPal account, PayPal charges 5% of the transaction with a minimum fee of $0.99 and a maximum fee of $4.99. This assumes the transfer is funded by a PayPal balance.

Do You Need a Bank Account for PayPal No, you don't need a bank account to sign up for PayPal or to receive payments. You can, however, connect your PayPal account to a bank account, a debit card or a credit card account for sending and receiving payments and transferring funds.It's free to use PayPal to donate or to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.

How much is PayPal fee for $1,000 : For example, if you are receiving a domestic invoice payment of $1,000, the PayPal fee would be ($1,000 x (3.49 ÷ 100)) + $0.49, or $35.39. Continuing with the previous example, if you want to receive a total amount of $1,000, you should charge ($1,000 + $0.49) ÷ (1 – (3.49 ÷ 100)), or $1,036.67.

![csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c1-1024x521-65x65.jpg)

![Ischiasschmerzen[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/Ischiasschmerzen1-1024x640-65x65.jpg)

![csm_blogbeitrag_autoimmunerkrankung_d307ac8b72[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_blogbeitrag_autoimmunerkrankung_d307ac8b721-1024x576-65x65.jpeg)