Antwort What are the top 3 PayPal disadvantages? Weitere Antworten – What are the negatives of PayPal

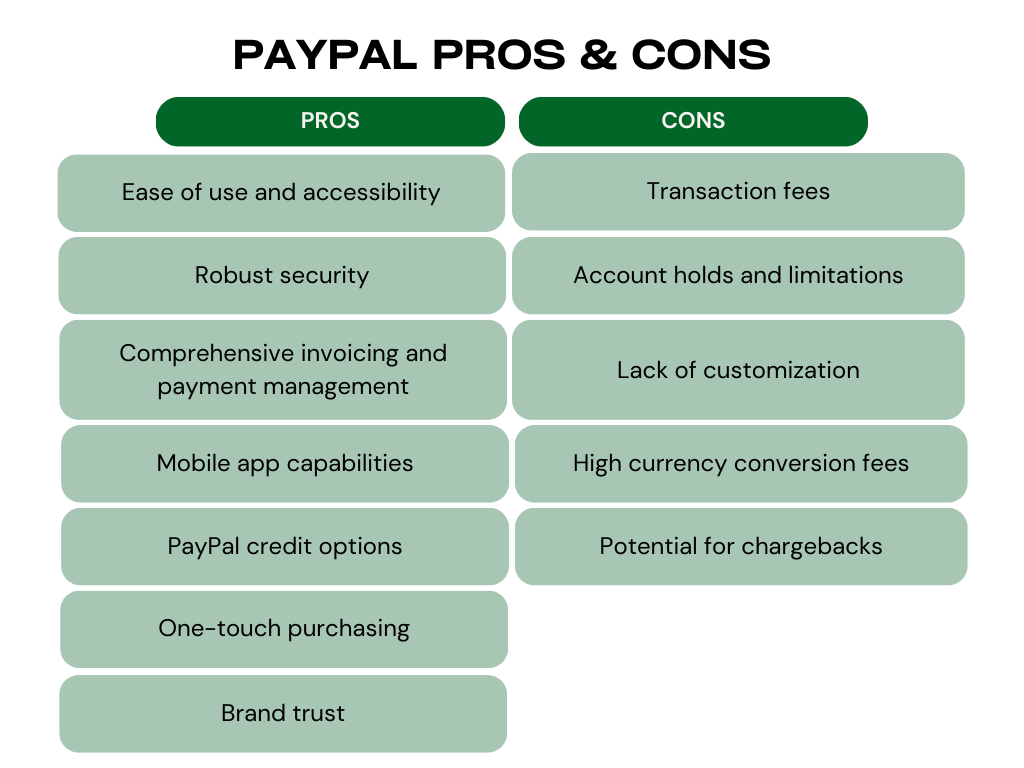

Cons:

- Fees on select transactions.

- Bank transfers take several days.

- Recent data breach of user account information.

Now, let's dive into the disadvantages of PayPal that business owners might face.

- Transaction fees. One of the most significant drawbacks of using PayPal for small businesses is its transaction fees.

- Account holds and limitations.

- Lack of customization.

- High currency conversion fees.

- Potential for chargebacks.

Shares of the digital payments pioneer are down 81% from their peak price. In 2023, they dipped 14%, as the Nasdaq Composite index surged 43%. Despite its terrible performance, this beaten-down fintech stock might just be the best business to add to your portfolio in 2024.

:max_bytes(150000):strip_icc()/is-paypal-safe-315818-v3-5b477342c9e77c00377efb8f.png)

Is PayPal still the best : PayPal is one of the most trusted names when it comes to payment processing, and when it comes to customers spending money on your services, that name recognition can go a long way in terms of getting people to make a purchase.

What are two pros and cons of PayPal

PayPal Business Overview

| PROS | CONS |

|---|---|

| Wide range of payment solutions | Reports of frozen accounts and funds |

| Over 26 currencies plus cryptocurrencies | Complex pricing structure |

| Strong invoicing features | Not compatible with high-risk merchants |

| Instant fund access via PayPal Balance | Popular target for phishing and scams |

Is PayPal safer than bank : Key takeaways. PayPal and credit cards both offer protection when shopping online. PayPal protects shoppers if items go missing or arrive damaged. Using PayPal or a credit card is safer than using your debit card.

Government regulators said Thursday that people who keep cash with payment tools like Cash App, PayPal and Venmo are at risk of losing their money in a crisis because the funds are not protected by federal deposit insurance.

:max_bytes(150000):strip_icc()/paypal.asp-final-1101556384f049bf9f24d7ad7a59494c.jpg)

Additionally, the fintech industry has seen rising competition. PayPal has seen its market share leads in applications like peer-to-peer payments and buy now, pay later (BNPL) come under fire. Block's CashApp threatens Venmo, and Affirm, Klarna, and Afterpay are coming after PayPal in the BNPL space.

Is it safe to save money in PayPal

Is PayPal Savings FDIC-insured With PayPal Savings, your money is deposited at Synchrony Bank, Member FDIC, and is eligible for Federal Deposit Insurance Corporation (FDIC) deposit insurance coverage up to $250,000.00 USD.It is recommended to withdraw your funds regularly, keeping only enough for a few average order refunds and use linked funding sources to pay vendors as PayPal is not a bank and can freeze accounts, tying up your funds, to verify identity, for suspicious activity or for violation of User Agreement/Acceptable Use Policy …PayPal has extensive security measures in place to secure bank account information, including the use of end-to-end encryption on every transaction, firewalls, and storing all financial information in one secure online vault. Can my PayPal account get hacked Technically, your PayPal account is safe from hacking.

If you link a bank account to your PayPal account, we'll take the money directly from your bank account when you make a purchase or send money. We'll send you a receipt every time you make a payment from your bank account, giving you an easy way to track your spending. Was this article helpful

Can someone access your bank account through PayPal : We keep all your information secure. For example, when you use PayPal to send a payment, the recipient doesn't receive sensitive financial details like your credit card or bank account number. You don't have to worry about paying someone online.

How safe is my money in PayPal : For example, when you use PayPal to send a payment, the recipient doesn't receive sensitive financial details like your credit card or bank account number. You don't have to worry about paying someone online. Additionally, when you pay with PayPal on any website, you're covered by PayPal Purchase Protection.

Is my money safe through PayPal

Every transaction is heavily guarded behind our advanced encryption. If something seems fishy, our dedicated team of security specialists will identify suspicious activity and help protect you from fraudulent transactions. Remember, we will never ask for any sensitive information.

:max_bytes(150000):strip_icc()/digital-wallet.asp-FINAL-2-3a1808ac331f411da5e0e516d9ec69fc.png)

PayPal thinks it found a "Fastlane" to higher growth

In 2024, for example, e-commerce retail sales are expected to grow by 9.4%. That's higher than PayPal's revenue growth in recent quarters. All PayPal needs to do is figure out how to grow alongside its core market, ideally gaining market share along the way.1) Leave it as long as you like. If it sits dormant for a few years, we may legally have to send the funds to your state as abandoned property, so just don't go three years or more without logging in at all and you'll be good here. 2) Unclaimed funds are only if you do not accept or deny a payment.

Is it smart to keep money in PayPal : Apps like Venmo, Cash App and PayPal, while often quick and convenient to use, are not actually banks. As such, the money they hold often lacks the insurance that protects deposits at traditional financial institutions. Start saving today with a High-Yield Savings Account.

![csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c1-1024x521-65x65.jpg)

![Ischiasschmerzen[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/Ischiasschmerzen1-1024x640-65x65.jpg)

![csm_blogbeitrag_autoimmunerkrankung_d307ac8b72[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_blogbeitrag_autoimmunerkrankung_d307ac8b721-1024x576-65x65.jpeg)