Antwort What is a disadvantage of PayPal? Weitere Antworten – What are the disadvantages of PayPal

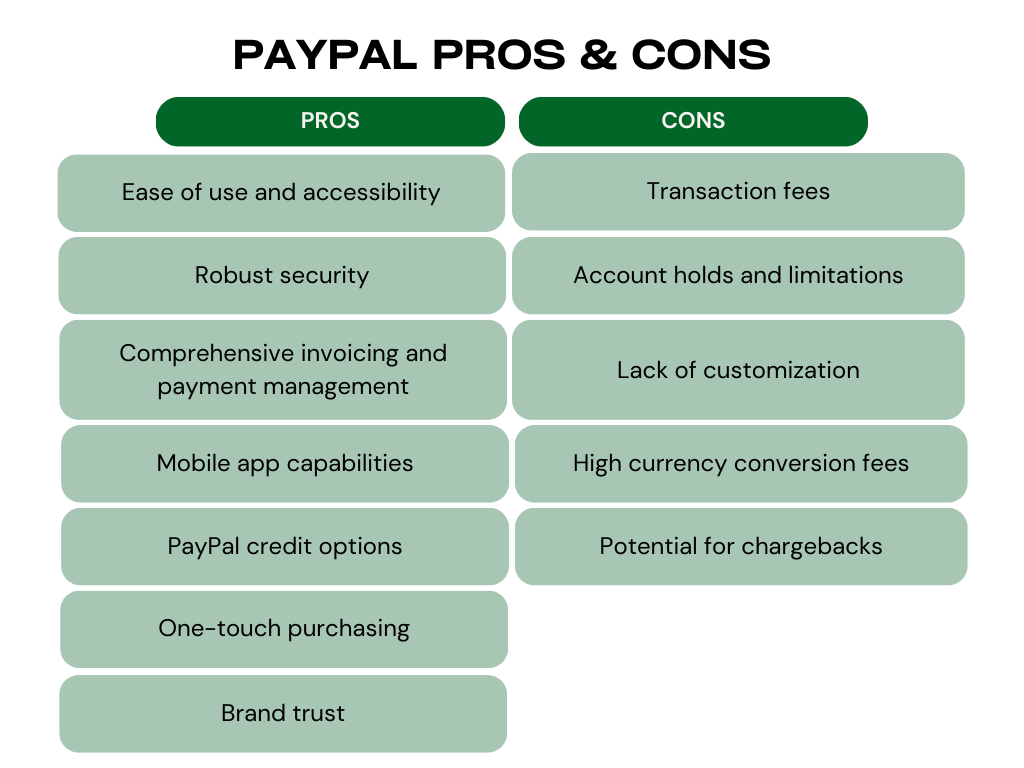

Now, let's dive into the disadvantages of PayPal that business owners might face.

- Transaction fees. One of the most significant drawbacks of using PayPal for small businesses is its transaction fees.

- Account holds and limitations.

- Lack of customization.

- High currency conversion fees.

- Potential for chargebacks.

While it is generally safe to send money using PayPal, it does come with risks. Like many online platforms, especially those with a large volume of financial and personal information, PayPal is a popular target for dangerous hackers, criminals, and other scammers.Benefits of PayPal

PayPal makes it easy to send, receive, or request money with family and friends securely. You can send money from your PayPal balance or a linked bank account, debit card, or credit card. You must have a PayPal account before you can send or receive money transfers.

How does PayPal make money : PayPal Fees

PayPal makes much of its revenue from fees it charges merchants, rather than from the consumers who pay with it. There is no fee for using PayPal to pay for a transaction if the payment is in your home currency.

What risks does PayPal face

The most common risks associated with PayPal include email phishing scams, fake or canceled invoices, shipping scams, charity scams, and more. Read this article for a more detailed overview of PayPal scams. Is it safer to pay with PayPal or debit card

What are two pros and cons of PayPal : PayPal Business Overview

| PROS | CONS |

|---|---|

| Wide range of payment solutions | Reports of frozen accounts and funds |

| Over 26 currencies plus cryptocurrencies | Complex pricing structure |

| Strong invoicing features | Not compatible with high-risk merchants |

| Instant fund access via PayPal Balance | Popular target for phishing and scams |

When you pay for an eligible item from your PayPal account and you don't receive your order, or it shows up significantly different than described, you may be eligible for a refund under PayPal's Purchase Protection program.

:max_bytes(150000):strip_icc()/is-paypal-safe-315818-v3-5b477342c9e77c00377efb8f.png)

One of the main advantages to using PayPal is it uses a centralised system to keep your private information safe through encryption. This makes it attractive to people using services that require regular monetary deposits, such as online subscriptions or even online casinos.

Does PayPal charge a fee

It's free to use PayPal to donate or to pay for a purchase or any other type of commercial transaction unless it involves a currency conversion.Do You Need a Bank Account for PayPal No, you don't need a bank account to sign up for PayPal or to receive payments. You can, however, connect your PayPal account to a bank account, a debit card or a credit card account for sending and receiving payments and transferring funds.Do You Need a Bank Account for PayPal No, you don't need a bank account to sign up for PayPal or to receive payments. You can, however, connect your PayPal account to a bank account, a debit card or a credit card account for sending and receiving payments and transferring funds.

PayPal is facing blowback after proposing rules that would have allowed it to fine users $2,500 for promoting misinformation — which the online payment service has since called an error.

Is it safe to keep money in PayPal : It is recommended to withdraw your funds regularly, keeping only enough for a few average order refunds and use linked funding sources to pay vendors as PayPal is not a bank and can freeze accounts, tying up your funds, to verify identity, for suspicious activity or for violation of User Agreement/Acceptable Use Policy …

What are the positives and negatives of PayPal : PayPal Business Overview

| PROS | CONS |

|---|---|

| Over 26 currencies plus cryptocurrencies | Complex pricing structure |

| Strong invoicing features | Not compatible with high-risk merchants |

| Instant fund access via PayPal Balance | Popular target for phishing and scams |

| Merchant & customer financing options | Poor and hard-to-reach customer service |

Can PayPal take money from my bank account

If you link a bank account to your PayPal account, we'll take the money directly from your bank account when you make a purchase or send money. We'll send you a receipt every time you make a payment from your bank account, giving you an easy way to track your spending. Was this article helpful

PayPal is a safe and convenient way to make payments for goods and services, send money to friends and family or receive customer payments. The platform also provides robust safety protocols for buyers and sellers, such as fraud protection, data encryption and continuous monitoring.Using PayPal to make a purchase typically just requires verifying saved information, without needing to enter it manually. PayPal also allows users to make peer-to-peer payments. Frequent users may even be inclined to apply for a reward-earning PayPal credit card or PayPal's line of credit.

Why don’t Americans use PayPal : One of the most cited barriers is lack of interest: 67% of Americans who say they have never used PayPal, Venmo, Zelle or Cash App say not being interested is a major reason. Those who do not have experience with these money-transferring platforms also point to a lack of necessity, as well as distrust.

![csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_2405-bauerfeind-produktkategoriesseiten-bandagen-ellenbogenbandage-2560x1400_88-1_f91f66009c1-1024x521-65x65.jpg)

![Ischiasschmerzen[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/Ischiasschmerzen1-1024x640-65x65.jpg)

![csm_blogbeitrag_autoimmunerkrankung_d307ac8b72[1]](https://www.nakajimamegumi.com/wp-content/uploads/2024/06/csm_blogbeitrag_autoimmunerkrankung_d307ac8b721-1024x576-65x65.jpeg)